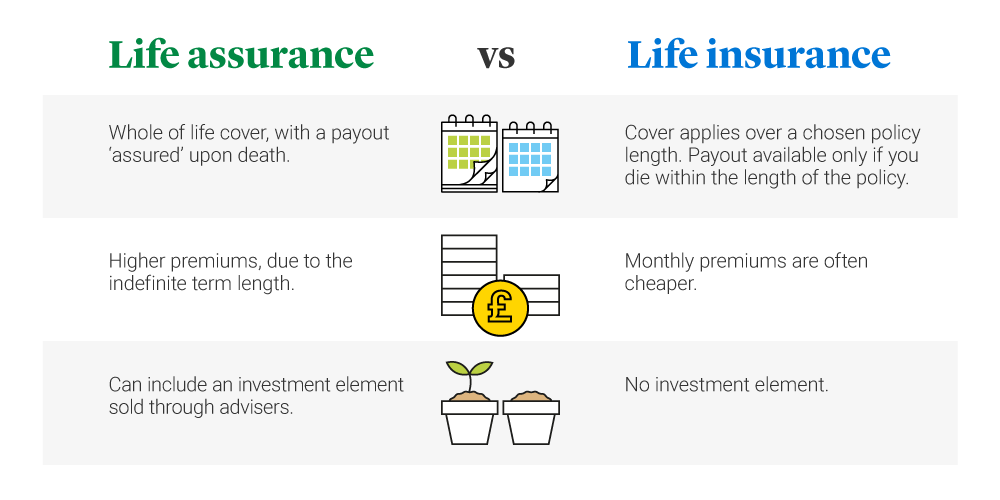

Life insurance lasts an agreed term which is a number of years and can vary. On the flip side assurance is for the long term which operates over a number of years.

Assurance Vs Insurance Meaning. Insurance is about having peace of mind about valuable things and whatever is valuable to you can be insured. Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding. The difference between insurance and assurance shows that insurance gives security against a foreseen occasion. What is life insurance.

Life Assurance Vs Life Insurance Legal General From legalandgeneral.com

Life Assurance Vs Life Insurance Legal General From legalandgeneral.com

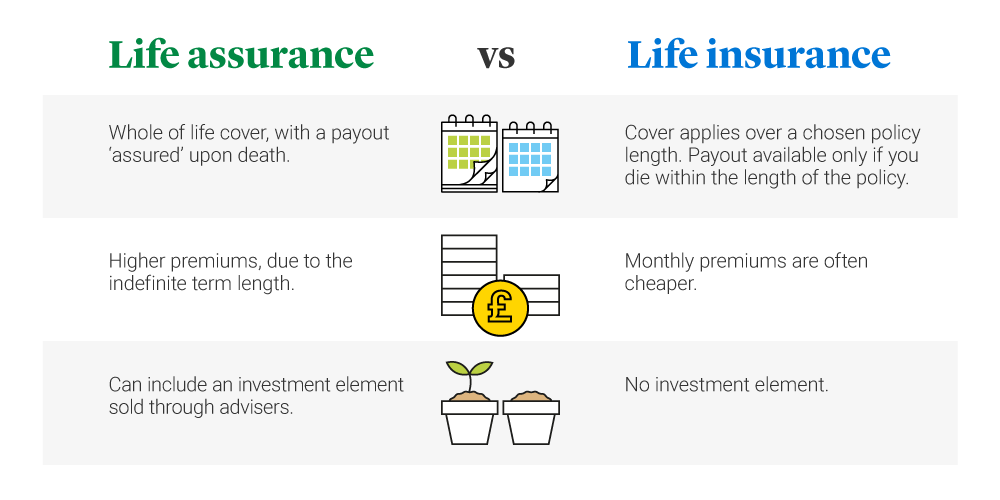

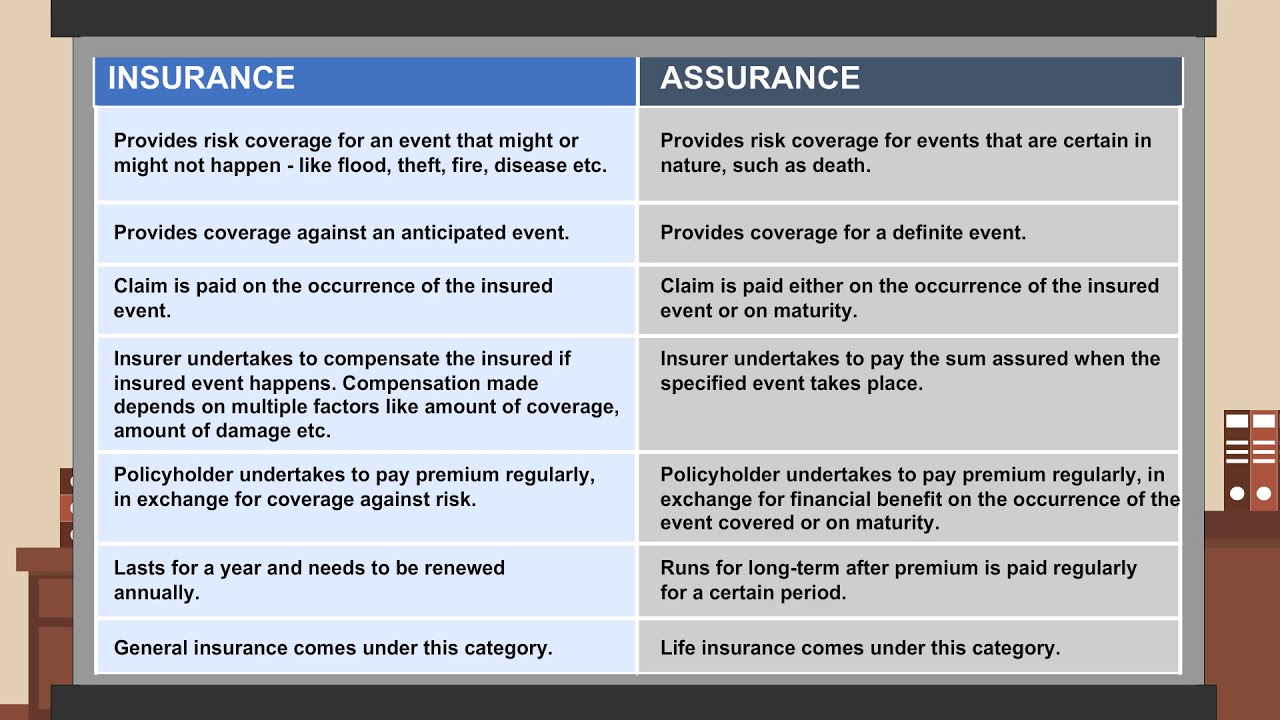

Assurance has a broader meaning as it is connected to the knowledge that something is going to occur. The main difference is that a life insurance plan is customized for covering the policyholders for a particular tenure while life assurance generally covers the policyholders for the whole. If you dont die during the. Assurance covers life insurance such as whole life insurance term life insurance and annuity. Insurance helps to reinstate the financial position and achieve financial stability during an unforeseen event. That event can be insured but the assurance is linked to the fact that something is going to take place.

If you dont die during the.

Assurance pays out a predetermined sum when an event takes place. However there are subtle differences between the two which are as follows. Life insurance lasts an agreed term which is a number of years and can vary. An insurer may refer to life assurance meaning the cover is indefinite with no fixed expiry date unlike a life insurance policy term.

Source: mymoneysage.in

Source: mymoneysage.in

Then again assurance gives insurance against a specific occasion. In regular terminology the term assurance has a slight different meaning. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. The term refers to putting someone at ease ensuring someone or clearing someones doubts. Assurance provides coverage for an inevitable event such as death or tenure completion.

Source: in.pinterest.com

Source: in.pinterest.com

The word assurance is used because youre assured that a valid claim will be paid regardless of when you die so long as you pay your premiums. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. That event can be insured but the assurance is linked to the fact that something is going to take place. Assurance provides coverage for events that will occur such as death. The difference between insurance and assurance shows that insurance gives security against a foreseen occasion.

Source:

Source:

Life insurance lasts an agreed term which is a number of years and can vary. If you dont die during the. Assurance basically means till life. The word assurance is used because youre assured that a valid claim will be paid regardless of when you die so long as you pay your premiums. Assurance pays out a predetermined sum when an event takes place.

Source: iedunote.com

Source: iedunote.com

The key difference between life insurance and life assurance is the length of the policy. Assurance basically means till life. The difference between insurance and assurance shows that insurance gives security against a foreseen occasion. On the flip side assurance is for the long term which operates over a number of years. However there are subtle differences between the two which are as follows.

Source: legalandgeneral.com

Source: legalandgeneral.com

When using assurance to refer to financial products it has a very similar definition to insurance. Then again assurance gives insurance against a specific occasion. While insurance depends on the guideline of repayment assurance is somewhat unique which relies upon the standard of sureness. Difference between Insurance and Assurance. Life insurance lasts an agreed term which is a number of years and can vary.

Source: youtube.com

Source: youtube.com

The main difference is that a life insurance plan is customized for covering the policyholders for a particular tenure while life assurance generally covers the policyholders for the whole. Difference between Insurance and Assurance. Assurance provides financial coverage for events whose happening is certain such as death. What is life insurance. However they do not work in the same manner.

Source: youtube.com

Source: youtube.com

On the flip side assurance is for the long term which operates over a number of years. Insurance is mostly used in general insurance like car and bike insurance which will cover accidents and damages to the car while assurance is used with life insurance policies which will cover the death benefit for the policyholder. Life assurance can be another way of describing a whole of life policy. Insurance gives financial stability in the face of uncertainties. Insurance helps to reinstate the financial position and achieve financial stability during an unforeseen event.

Source: keydifferences.com

Source: keydifferences.com

Assurance provides financial coverage for events whose happening is certain such as death. Insurance is mostly used in general insurance like car and bike insurance which will cover accidents and damages to the car while assurance is used with life insurance policies which will cover the death benefit for the policyholder. The key difference between assurance and insurance is listed below- Insurance is the policy where the insured part gets the financial coverage for the loss that occurs due to any natural calamity or any personal mishappening whereas assurance provides coverages for events that are definite to happen sooner or later in the life of the person getting insured. Assurance basically means till life. However insurance refers to coverage over a limited time whereas assurance applies to persistent coverage for extended periods or until death.

Source: turtlemint.com

Source: turtlemint.com

That event can be insured but the assurance is linked to the fact that something is going to take place. Insurance is mostly used in general insurance like car and bike insurance which will cover accidents and damages to the car while assurance is used with life insurance policies which will cover the death benefit for the policyholder. Assurance has a broader meaning as it is connected to the knowledge that something is going to occur. The terms insurance and assurance are used frequently in the financial industry. Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding.

Source: in.pinterest.com

Source: in.pinterest.com

The key difference between assurance and insurance is listed below- Insurance is the policy where the insured part gets the financial coverage for the loss that occurs due to any natural calamity or any personal mishappening whereas assurance provides coverages for events that are definite to happen sooner or later in the life of the person getting insured. Both of these are the types of security that are designed for paying out after the demise of the policyholder. Both insurance and assurance are financial products offered by companies operating commercially but of late the distinction between the two has increasingly become blurred and the two are taken to be somewhat similar. Then again assurance gives insurance against a specific occasion. When using assurance to refer to financial products it has a very similar definition to insurance.

Source: wishpolicy.com

Source: wishpolicy.com

On the flip side assurance is for the long term which operates over a number of years. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. An insurer may refer to life assurance meaning the cover is indefinite with no fixed expiry date unlike a life insurance policy term. Both of these are the types of security that are designed for paying out after the demise of the policyholder. Assurance basically means till life.

Source: aegonlife.com

Source: aegonlife.com

Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. Insurance provides protection against uncertain events such as fire theft accidents and flood etc. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. Assurance covers life insurance such as whole life insurance term life insurance and annuity. However there are subtle differences between the two which are as follows.

Source: mymoneysage.in

Source: mymoneysage.in

Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding. Assurance basically means till life. The key difference between assurance and insurance is listed below- Insurance is the policy where the insured part gets the financial coverage for the loss that occurs due to any natural calamity or any personal mishappening whereas assurance provides coverages for events that are definite to happen sooner or later in the life of the person getting insured. Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding. Assurance provides coverage for an inevitable event such as death or tenure completion.

Source: turtlemint.com

Source: turtlemint.com

In regular terminology the term assurance has a slight different meaning. Assurance has a broader meaning as it is connected to the knowledge that something is going to occur. Assurance provides coverage for events that will occur such as death. Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding. Insurance is about having peace of mind about valuable things and whatever is valuable to you can be insured.

Source: differencebetween.net

Source: differencebetween.net

Assurance provides financial coverage for events whose happening is certain such as death. The key difference between assurance and insurance is listed below- Insurance is the policy where the insured part gets the financial coverage for the loss that occurs due to any natural calamity or any personal mishappening whereas assurance provides coverages for events that are definite to happen sooner or later in the life of the person getting insured. What is life insurance. Insurance is mostly used in general insurance like car and bike insurance which will cover accidents and damages to the car while assurance is used with life insurance policies which will cover the death benefit for the policyholder. Assurance covers life insurance such as whole life insurance term life insurance and annuity.

Source: acko.com

Source: acko.com

When using assurance to refer to financial products it has a very similar definition to insurance. While insurance depends on the guideline of repayment assurance is somewhat unique which relies upon the standard of sureness. According to my experience the key difference between life insurance life assurance is that - with life insurance you can be covered even if you die within the term of the policy but as far as life assurance is concerned it is there for when you eventually pass away. When using assurance to refer to financial products it has a very similar definition to insurance. The term refers to putting someone at ease ensuring someone or clearing someones doubts.

Source: aegonlife.com

Source: aegonlife.com

While insurance depends on the guideline of repayment assurance is somewhat unique which relies upon the standard of sureness. The key difference between life insurance and life assurance is the length of the policy. In regular terminology the term assurance has a slight different meaning. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. An insurer may refer to life assurance meaning the cover is indefinite with no fixed expiry date unlike a life insurance policy term.

Source: keydifferences.com

Source: keydifferences.com

The word assurance is used because youre assured that a valid claim will be paid regardless of when you die so long as you pay your premiums. Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding. Assurance has a broader meaning as it is connected to the knowledge that something is going to occur. Assurance provides financial coverage for events whose happening is certain such as death. Assurance covers life insurance such as whole life insurance term life insurance and annuity.