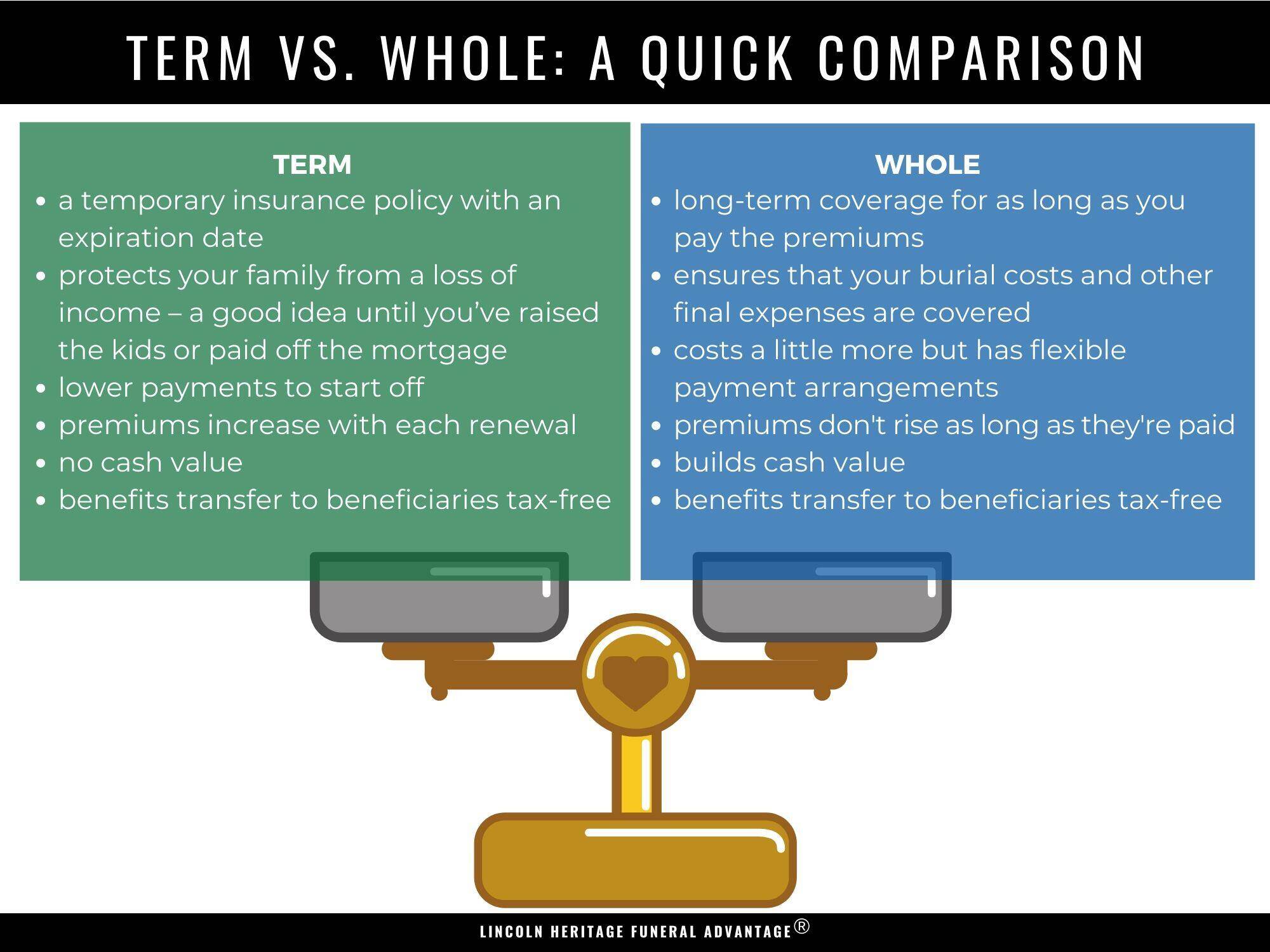

Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Converting can make sense if you want the benefits permanent life insurance offers.

Convertible Term Assurance Policy. Rather than choosing a traditional term life policy and watching as it expires the conversion rider provides an option for what happens after whether it renews year-by-year or converts into a permanent option. It gives you the flexibility to keep your life cover in place if. The convertible term insurance premium is determined at the initiation of the plan. LIC Convertible Term Assurance plan is a term insurance plan which offers affordable and low premiums.

Lic Convertible Term Assurance Plan Details Premium Benefits Features From wishpolicy.com

Lic Convertible Term Assurance Plan Details Premium Benefits Features From wishpolicy.com

Convertible Term Assurance Policy Table No. Convertible term assurance policies are life assurance policies with a specified term. Convertible term insurance is like term insurance but with an additional benefit. This plan is specifically designed for those individuals for whom a high premium is not affordable. A convertible insurance policy is a term related to life insurance. Its also known as a conversion option as part of a term life insurance policy.

If you choose to exercise this option it allows you to convert all or a portion of the existing death benefit to permanent insurance coverage such as whole life or universal life with no evidence of insurability required ie.

Click to open Decreasing term assurance. The option must be exercised before the plan ends. Convertible Term Assurance Policy holders get an option of converting an policy into endowment assurance or limited payment whole life assurance. Converting part of your policy can help you meet your goals and manage your budget.

Source: nilife.com

Source: nilife.com

This type of cover is cheaper than level term due. Any 5 years term policy is renewable without any medical evidence. This plan is specifically designed for those individuals for whom a high premium is not affordable. It gives you the flexibility to keep your life cover in place if. No medical exam or health questions.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Convertible term assurance policies are life assurance policies with a specified term. All things considered both renewable and convertible term life insurance policies can be useful to the right people. Convertible term insurance is like term insurance but with an additional benefit. Convertible term assurance policies are life assurance policies with a specified term. Convertible Term Assurance Policy holders get an option of converting an policy into endowment assurance or limited payment whole life assurance.

Source: myinsuranceclub.com

Source: myinsuranceclub.com

This type of cover is cheaper than level term due. 100 of Sum Assured is payable in one lump sum. In a term insurance plan at the maturity of the policy no benefit is paid. Convertible term assurance policies are life assurance policies with a specified term. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

58 is a plan with an option to convert the policy to whole life limited Payment Assurance or Endowment Assurance at any time during the specified term without under going fresh medical examination. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. It gives you the flexibility to keep your life cover in place if. Convertible term insurance lets you trade in a temporary policy for a permanent one. Term life insurance is a policy that provides the insured person coverage for a certain period of time.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

All things considered both renewable and convertible term life insurance policies can be useful to the right people. 58 is a plan with an option to convert the policy to whole life limited Payment Assurance or Endowment Assurance at any time during the specified term without under going fresh medical examination. A convertible insurance policy is a term related to life insurance. Convertible Term Assurance Policy Table No. We advise you to read the actual policy documents for important details on coverage exclusions.

Source: coverfox.com

Source: coverfox.com

Convertible term assurance policies are life assurance policies with a specified term. Convertible Term Assurance Like Renewable Term Assurance this type of term assurance contains an option at the end of the term. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Converting part of your policy can help you meet your goals and manage your budget. No medical exam or health questions.

Source: myinsuranceclub.com

Source: myinsuranceclub.com

This plan is specifically designed for those individuals for whom a high premium is not affordable. However the benefits might change. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. This type of policy is useful to cover a reducing loan such as a repayment mortgage if you die during the term. If you choose to exercise this option it allows you to convert all or a portion of the existing death benefit to permanent insurance coverage such as whole life or universal life with no evidence of insurability required ie.

Source: kamuslengkap.com

Source: kamuslengkap.com

Convertible Term Assurance Like Renewable Term Assurance this type of term assurance contains an option at the end of the term. Convertible term assurance policies are life assurance policies with a specified term. Converting can make sense if you want the benefits permanent life insurance offers. 100 of Sum Assured is payable in one lump sum. Click to open Decreasing term assurance.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Convertible term assurance policies are life assurance policies with a specified term. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. Convertible term assurance policies are life assurance policies with a specified term. This conversion option allows you to adapt your plan if your circumstances change. The option must be exercised before the plan ends.

Source: lhlic.com

Source: lhlic.com

Convertible term assurance policies are life assurance policies with a specified term. Click to open Decreasing term assurance. The convertible term insurance premium is determined at the initiation of the plan. Convertible term insurance is like term insurance but with an additional benefit. Convertible term assurance is a type of policy that allows you to convert to a whole of life policy at the end of its term without providing new medical information.

Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Convertible term assurance is a type of policy that allows you to convert to a whole of life policy at the end of its term without providing new medical information. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Rather than choosing a traditional term life policy and watching as it expires the conversion rider provides an option for what happens after whether it renews year-by-year or converts into a permanent option. Convertible Term Assurance Policy holders get an option of converting an policy into endowment assurance or limited payment whole life assurance.

Source: nilife.com

Source: nilife.com

Term life insurance is a policy that provides the insured person coverage for a certain period of time. Life cover decreases during the term of the policy. Convertible into whole life or endowment plan without medical evidence. Convertible term assurance is a type of policy that allows you to convert to a whole of life policy at the end of its term without providing new medical information. In a term insurance plan at the maturity of the policy no benefit is paid.

Source: insuranceandestates.com

Source: insuranceandestates.com

Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. This time it is to convert it into a whole of life policy without the need for a medical. Convertible term assurance policies are life assurance policies with a specified term. 100 of Sum Assured is payable in one lump sum.

Source: learnpick.in

Source: learnpick.in

A convertible insurance policy is a term related to life insurance. Convertible term assurance is a type of policy that allows you to convert to a whole of life policy at the end of its term without providing new medical information. Converting can make sense if you want the benefits permanent life insurance offers. No medical exam or health questions. Convertible Term Assurance Like Renewable Term Assurance this type of term assurance contains an option at the end of the term.

Source: wishpolicy.com

Source: wishpolicy.com

This time it is to convert it into a whole of life policy without the need for a medical. Convertible term insurance is like term insurance but with an additional benefit. Convertible term assurance is a type of policy that allows you to convert to a whole of life policy at the end of its term without providing new medical information. However they also come with the option to convert. Term life insurance is a policy that provides the insured person coverage for a certain period of time.

Source: slideshare.net

Source: slideshare.net

58 is a plan with an option to convert the policy to whole life limited Payment Assurance or Endowment Assurance at any time during the specified term without under going fresh medical examination. Please note that this brief summary is not a policy document. Convertible term assurance policies are life assurance policies with a specified term. Convertible term assurance policies are life assurance policies with a specified term. Click to open Decreasing term assurance.

Source: paisabazaar.com

Source: paisabazaar.com

Convertible term assurance policies are life assurance policies with a specified term. 58 is a plan with an option to convert the policy to whole life limited Payment Assurance or Endowment Assurance at any time during the specified term without under going fresh medical examination. Convertible term assurance policies are life assurance policies with a specified term. The convertible term insurance premium is determined at the initiation of the plan. Even after the conversion the premium will remain the same.

Source: zurich.ie

Source: zurich.ie

All things considered both renewable and convertible term life insurance policies can be useful to the right people. On the other hand a. If you choose to exercise this option it allows you to convert all or a portion of the existing death benefit to permanent insurance coverage such as whole life or universal life with no evidence of insurability required ie. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. The policyholder has a conversion option which means they can convert the cover under the policy into a new policy running for a longer period of time without the insured person having to undergo a medical examination or supply evidence of good health at the time of the conversion.