Term life insurance plans keep you covered financially for a set period of time. You pay the same amount each month or year but your death benefit grows smaller.

Decreasing Term Assurance Definition. These plans are generally more affordable than other types of term life insurance making them a smart choice if you just need insurance to cover a temporary need or plan to leave little to no debt for your family to. How often your benefit decreases and the amount it decreases is set when you buy your policy. The death benefit will decrease on a monthly or annual basis. Premiums normally remain the same throughout the life of the policy which can range from one to 30 years.

Medical Insurance Terms Definitions Medical Insurance Medical Definitions From in.pinterest.com

Medical Insurance Terms Definitions Medical Insurance Medical Definitions From in.pinterest.com

Decreasing term insurance is a life insurance product that provides decreasing coverage over the term of the policy. Decreasing Term Insurance A term life insurance policy in which the policyholder pays a constant premium but the benefit decreases over time either on a monthly quarterly or yearly basis. The premiums do not however reduce. Its usually purchased to help clear a specific debt such as a repayment mortgage. No benefit on survival. The exact amount of.

Its usually purchased to help clear a specific debt such as a repayment mortgage.

Term life insurance plans keep you covered financially for a set period of time. The death benefit will decrease on a monthly or annual basis. Decreasing refers to the pay-out reducing over time. Assurance shows that it is an insurance product.

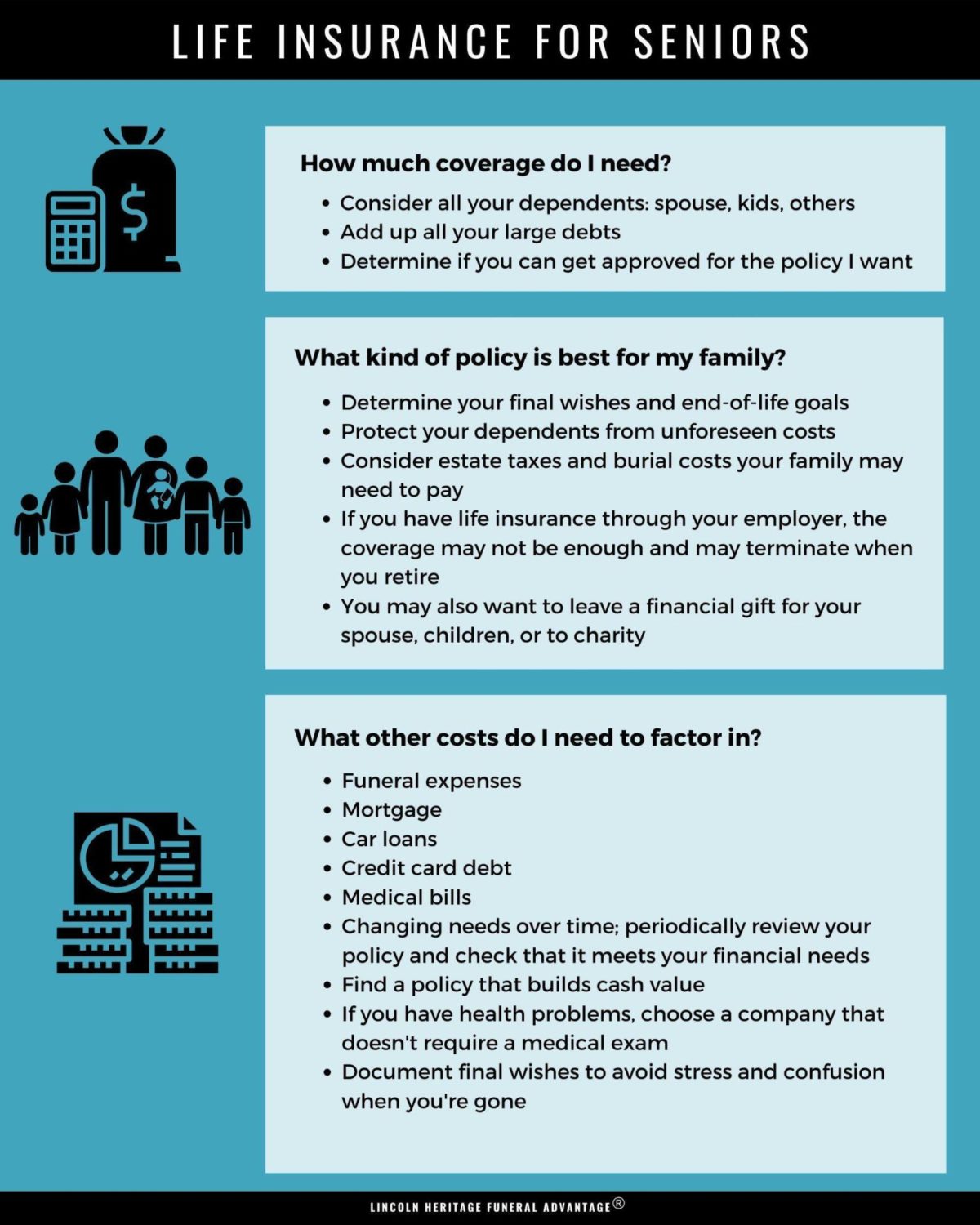

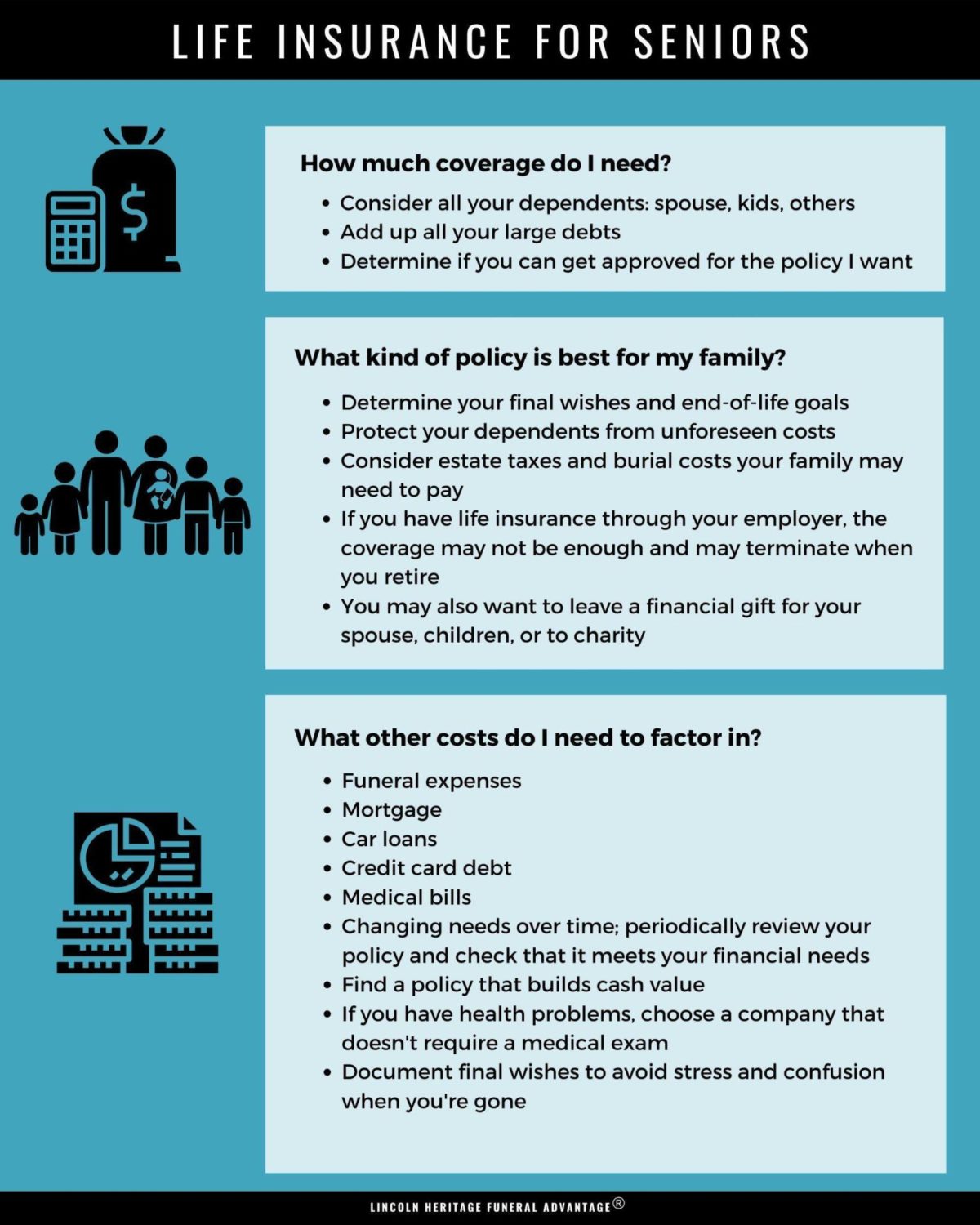

Source: lhlic.com

Source: lhlic.com

Assurance shows that it is an insurance product. Maurice HowseS COLUMN family finance It is one of the most inexpensive ways to protect a loan the only cheaper way would have been to have a decreasing term assurance policy where the sum goes down every year as you make payments to the bank or building society you. Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. Term means it has a fixed number of years to run and eventually expires. Decreasing Term Assurance to cover a loan is a form of Mortgage Protection.

Source: ringgitplus.com

Source: ringgitplus.com

Premiums are usually constant throughout the contract and. With a decreasing term life insurance policy the death benefit for the plan decreases over time. Decreasing term life insurance is defined as a term life policy that provides the beneficiary a gradually decreasing death benefit over the life of the policy. Decreasing term assurance uncountable Term assurance with a sum assured that decreases over the term of the contract. Decreasing refers to the pay-out reducing over time.

Source: insuranceandestates.com

Source: insuranceandestates.com

Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. The level of benefit decreases as the term of the policy runs. A life insurance agreement in which the amount paid over a fixed period of time is low and remains. Decreasing term assurance uncountable Term assurance with a sum assured that decreases over the term of the contract. Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years.

Source: in.pinterest.com

Source: in.pinterest.com

For example one may purchase a decreasing term life insurance policy for a. Decreasing term assurance uncountable Term assurance with a sum assured that decreases over the term of the contract. Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. The death benefit will decrease on a monthly or annual basis. Its usually purchased to help clear a specific debt such as a repayment mortgage.

Source: pinterest.com

Source: pinterest.com

Your life insurance premiums. The premiums are fixed throughout the policy term and the premium level is lower than that of Level Term Assurance as a result of the decreasing benefit. Maurice HowseS COLUMN family finance It is one of the most inexpensive ways to protect a loan the only cheaper way would have been to have a decreasing term assurance policy where the sum goes down every year as you make payments to the bank or building society you. Assurance shows that it is an insurance product. A decreasing term life insurance policy is the most common and cost-effective way of covering a repayment mortgage as the amount of cover can reduce over time in line with your mortgage balance.

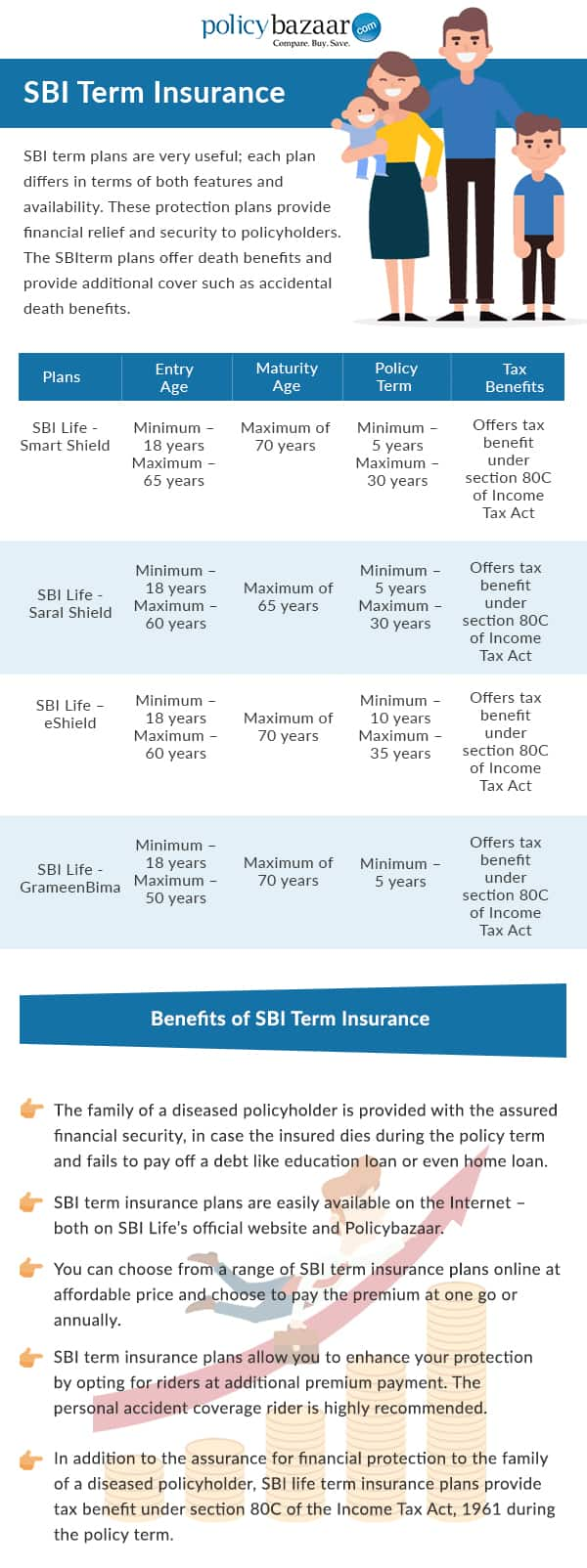

Source: policybazaar.com

Source: policybazaar.com

Similar to level term assurance but the amount of cover decreases over the period of the policy. The level of benefit decreases as the term of the policy runs. For example one may purchase a decreasing term life insurance policy for a. The premiums do not however reduce. Decreasing refers to the pay-out reducing over time.

Source: policybazaar.ae

Source: policybazaar.ae

You pay the same amount each month or year but your death benefit grows smaller. A decreasing term life insurance policy is typically cheaper than a level term policy because the death benefit your beneficiaries would receive is reduced over time. The level of benefit decreases as the term of the policy runs. Sum assured decreased to reflect the outstanding loan amount each year. How often your benefit decreases and the amount it decreases is set when you buy your policy.

Decreasing term life insurance is a type of term life insurance whose death benefit decreases at a set rate as the policy matures. Similar to level term assurance but the amount of cover decreases over the period of the policy. The level of benefit decreases as the term of the policy runs. Premiums are usually constant throughout the contract and. No benefit on survival.

Source: es.pinterest.com

Source: es.pinterest.com

Decreasing term life insurance is a type of term life insurance whose death benefit decreases at a set rate as the policy matures. Term means it has a fixed number of years to run and eventually expires. Premiums normally remain the same throughout the life of the policy which can range from one to 30 years. Its usually purchased to help clear a specific debt such as a repayment mortgage. For example one may purchase a decreasing term life insurance policy for a.

Source: pinterest.com

Source: pinterest.com

Decreasing term life insurance is defined as a term life policy that provides the beneficiary a gradually decreasing death benefit over the life of the policy. Decreasing term assurance definition. A decreasing term life insurance policy is typically cheaper than a level term policy because the death benefit your beneficiaries would receive is reduced over time. Decreasing term assurance uncountable Term assurance with a sum assured that decreases over the term of the contract. Decreasing term life insurance is a type of term life insurance whose death benefit decreases at a set rate as the policy matures.

Source: lhlic.com

Source: lhlic.com

Combining these three terms decreasing term life insurance or decreasing term life assurance DTA is a policy of financial cover that will pay a lump sum to your beneficiaries if you die within the period agreed the term. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label. Sum assured is paid out on death during the policy term. The level of benefit decreases as the term of the policy runs. The premiums do not however reduce.

Source: policybazaar.com

Source: policybazaar.com

You pay the same amount each month or year but your death benefit grows smaller. The death benefit will decrease on a monthly or annual basis. Term means it has a fixed number of years to run and eventually expires. For example one may purchase a decreasing term life insurance policy for a. Decreasing term assurance definition.

Source: ringgitplus.com

Source: ringgitplus.com

How often your benefit decreases and the amount it decreases is set when you buy your policy. The level of benefit decreases as the term of the policy runs. Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. The death benefit will decrease on a monthly or annual basis. Decreasing term insurance also called DTA insurance can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis.

Source: pinterest.com

Source: pinterest.com

These plans are generally more affordable than other types of term life insurance making them a smart choice if you just need insurance to cover a temporary need or plan to leave little to no debt for your family to. Premiums normally remain the same throughout the life of the policy which can range from one to 30 years. Term means it has a fixed number of years to run and eventually expires. Decreasing Term Insurance A term life insurance policy in which the policyholder pays a constant premium but the benefit decreases over time either on a monthly quarterly or yearly basis. A life insurance agreement in which the amount paid over a fixed period of time is low and remains.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Premiums are usually constant throughout the contract and. These plans are generally more affordable than other types of term life insurance making them a smart choice if you just need insurance to cover a temporary need or plan to leave little to no debt for your family to. Term means it has a fixed number of years to run and eventually expires. Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. The premiums do not however reduce.

Source: ringgitplus.com

Source: ringgitplus.com

Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. Decreasing term life insurance is defined as a term life policy that provides the beneficiary a gradually decreasing death benefit over the life of the policy. Premiums normally remain the same throughout the life of the policy which can range from one to 30 years. The level of benefit decreases as the term of the policy runs. Decreasing term insurance also called DTA insurance can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis.

Source: comparethemarket.com

Source: comparethemarket.com

Term means it has a fixed number of years to run and eventually expires. The death benefit will decrease on a monthly or annual basis. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Assurance shows that it is an insurance product. Similar to level term assurance but the amount of cover decreases over the period of the policy.

Source: legalandgeneral.com

Source: legalandgeneral.com

Term life insurance plans keep you covered financially for a set period of time. Decreasing term assurance definition. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label. A decreasing term life insurance policy is typically cheaper than a level term policy because the death benefit your beneficiaries would receive is reduced over time. Decreasing term insurance also called DTA insurance can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis.